Back to the Future 2025 Time Machines, Humanoid Robots, Trade Revolutions

The Transatlantic Post | Love Letter N°40

Welcome to The Transatlantic Post an editorial on innovation and international growth. With occasional British satire. By Kajal

Dear TP reader,

Last weekend, I watched Back to the Future Part II. The film was released in 1989 and its characters Marty McFly and Doc Brown travel to the future date of October 21, 2015. The film's depiction of the future included imaginative and futuristic predictions like hoverboards, flying cars, video calls, biometric scanners and fax machines (!)

It is fair to say some of the future predictions were confined to pure science fiction but others were spot on. The film also catapulted the DeLorean car (aka the Doc’s time machine) to fame. Few know the story of the DeLorean, it is a fascinating and cautionary tale of entrepreneurship, foreign direct investment and government incentives. More on that below in our top 5 story picks of the year.

Another reason I bring up Back to the Future is because the year end is a time for future predictions lists to land en masse in our inboxes. In 2016, when I first started writing the Transatlantic Post, the concept of humanoid robots might have sounded crazy but we are now perhaps on the cusp of a robotics revolution.

Nvidia the company that produces the global gold standard chips for AI computing is betting on robotics to drive future growth. It plans to launch its “Jetson Thor” computing platform in 2025, providing the processing power needed to bring sophisticated humanoid robots to life. Just imagine if you could have delegated all that Christmas shopping and cooking to your own in-house humanoid robot?

This year was also a breakout year for AI and AI-specific chip manufacturing which redefined world trade patterns. And despite rising geopolitical tension, global trade reached an unprecedented $33 trillion - a $1 trillion increase from 2023. Human ingenuity found its way out of one supply chain disruption after another to keep the wheels of open trade turning. Spain's olive oil crisis was a case in point. It sent the price of olive oil skyrocketing before the crisis was averted.

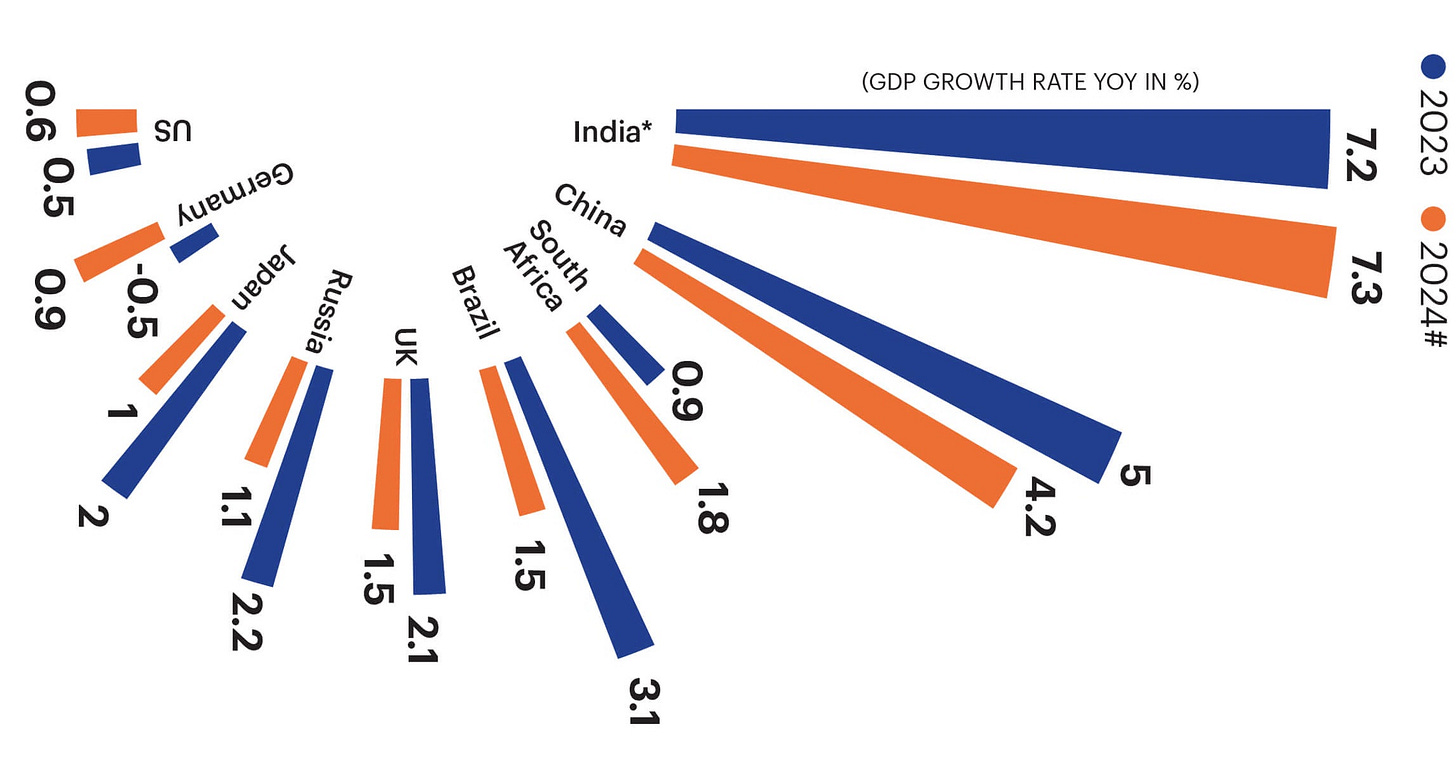

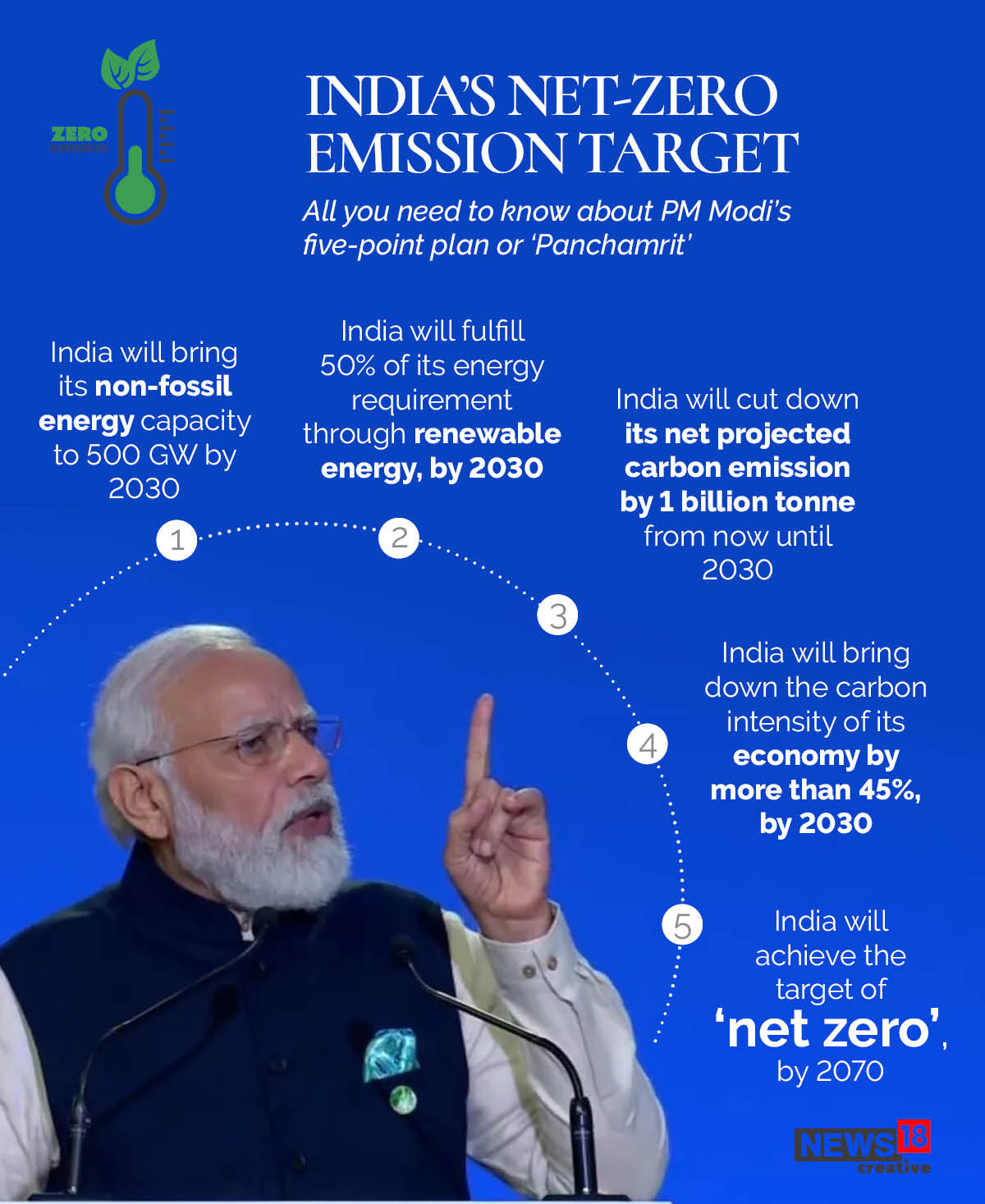

2024 also saw increased geopolitical fragmentation and in tandem shifting global power dynamics with new trade routes emerging, most notably between Africa and Asia, and between the Middle East and India. I have written much about the latter two markets in this year’s editons including India a 21st Century Superpower and MEINA Paving the Streets with Gold.

The global influence of both regions is set to gather pace given their economic momentum and sheer size of capital pools. Today, sovereign wealth funds in the Gulf manage $4.9 trillion and this is set to increase to $7.3 trillion by 2030. Also by 2030, India will be the second largest economy after the USA with 77% of their population under 44. The tides are turning quickly.

On a final note, this year there have been a few professional highlights. Working with the London School of Economics and a Ukrainian Government delegation to help their investment and reconstruction efforts and continuing to support and educate high-growth businesses to expand to the UAE and US. A thank you also to other partners we worked with including The Entrepreneurs Network and LSE IDEAS to launch our new website and serviceofferings this year.

As I shared in a recent LinkedIn Post, Growth Hub Global had its 8 year anniversary in December this year. For those of you thinking about starting businesses, make 2025 the year you take the leap, there has never been a better time to innovate.

I continue to be grateful for the opportunity to support innovative companies to grow internationally. In 2025, I will be looking at how new frontier technologies will shape trade and investment and how to embed AI to better support companies expand to new markets. In the meantime, wishing you all a very happy 2025!

“Trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window” P. Drucker

Sincerely, yours,

// 1 // The Story of the Back to the Future Delorean Time Machine

In 1978, John DeLorean chose Belfast, Northern Ireland, as the manufacturing site for his futuristic DMC-12 sports car, he wasn't just building cars – he was promising jobs and hope to a community torn apart by sectarian violence. With £100 million of British government funding, DeLorean set out to prove that business could succeed where politics had failed.

The Dunmurry factory quickly became one of Northern Ireland's largest employers, creating 2,500 manufacturing jobs in an area with 30% unemployment. Beyond direct employment, it stimulated local businesses supplying parts and services. Local pubs and shops reported increased trade, and housing demand rose in nearby neighborhoods as workers relocated closer to the plant.

Despite initial optimism however, Delorean's venture collapsed by 1982, just 28 months after production began. Poor sales, management issues, and John DeLorean's legal troubles led to bankruptcy, leaving workers jobless and the British government with massive losses.

Although the car was later made famous in the Back to the Future films, it was too late to rescue the company and the associated potential long term economic benefits to Northern Ireland. It serves as a cautionary tale to the promise of foreign direct investment and due diligence in vetting potential investors to new regions.

// 2 // The Rise of AI Semiconductor Manufacturing

Early 2024 saw unprecedented investment in semiconductor manufacturing, particularly for AI-specific chips. Major investments flowed into chip manufacturing across Japan, South Korea, and Europe. This represented a significant shift in global supply chains as countries worked to reduce dependency on any single-region for manufacturing.

In early 2024, Nvidia's H100 chip emerged as the gold standard for AI computing resulting in fairly significant geopolitical implications. AI capabilities became increasingly tied to national security interests, countries began viewing access to advanced chips as a strategic necessity. This led to export restrictions, particularly between the U.S. and China, forcing Nvidia to develop special chips that comply with export regulations and fuelled the already tense US-Chine trade relations in 2024.

As competition for AI chip supply increases, it will be interesting to see how this continues to shape global trade in 2025. Nvidia in the meantime is extending beyond chips to bet on a robotic future….

// 3 // 2025 the breakout year for Humanoid Robots?

Rapid advancements in AI—particularly in areas like computer vision, natural language processing, and machine learning are fuelling a robotics revolution. These advancements allow robots to “see,” understand, and respond to their surroundings with increasing sophistication.

Nvidia’s “Jetson Thor” will harness these capabilities to enable robots to interact more autonomously and seamlessly with humans and their environments. There are many sceptics that beleive humanoid robots cannot become so ubiquitous as to feature in our everyday lives. Whichever way the chips fall, it is a fascinating idea and journey to watch, take a look at the video below of a robot making your breakfast…

// 4 // The Price of Olive Oil

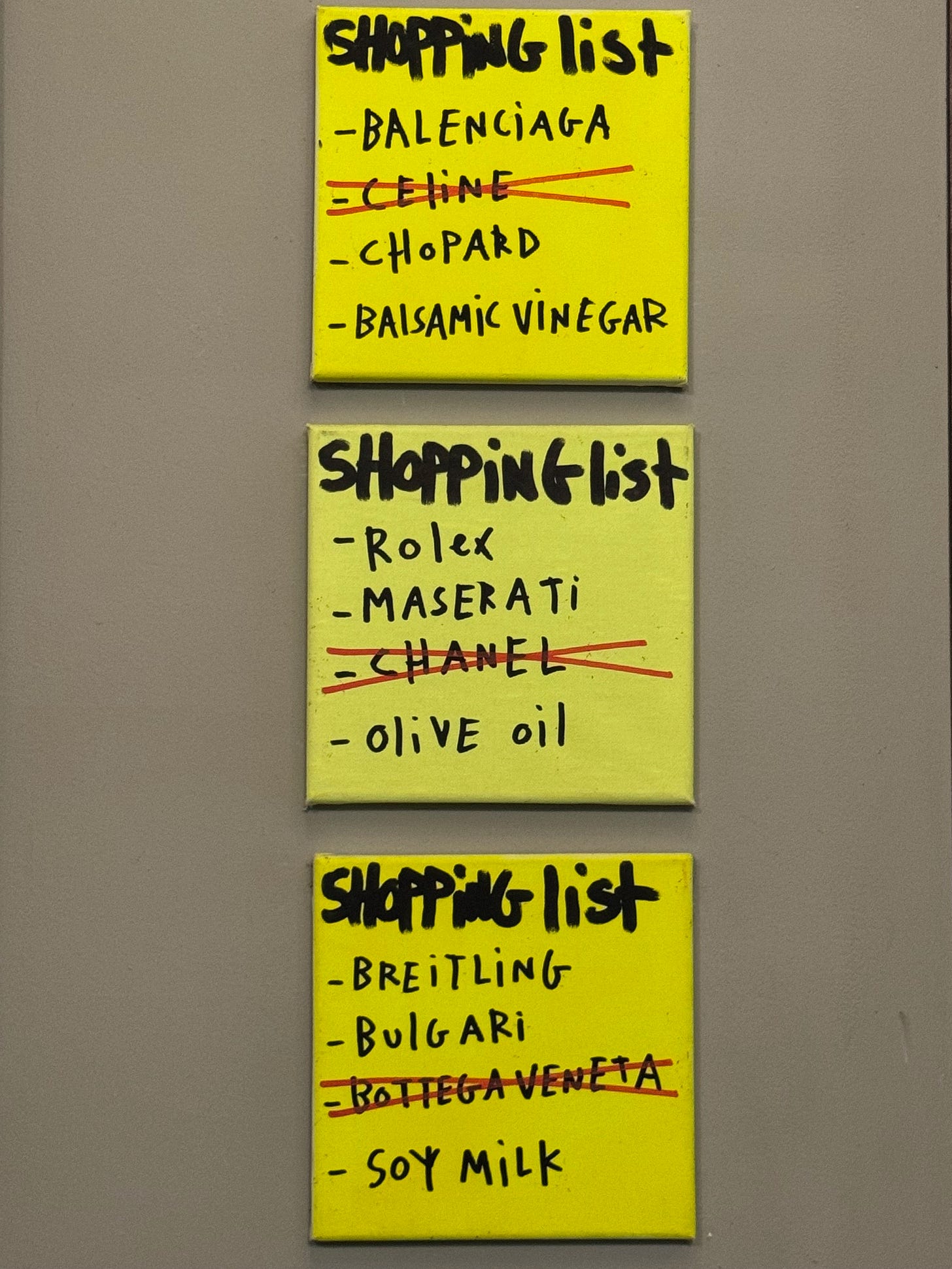

Below was an artwork I came across in an Italian cafe which sheds light on the cost of living crisis and prices of household staples including olive oil. The dramatic rise in olive oil prices in 2023-early 2024 stems from a perfect storm of climate and supply chain challenges. At the heart of the crisis was a drought in Spain, which typically produces about half of the world's olive oil. The summer of 2023 was Spain's hottest in 70 years. Olive trees are like marathon runners: they can handle tough conditions, but extreme heat and drought force them to focus on survival rather than producing fruit. This stress led to some Spanish olive groves producing just 20% of their normal yield.

The price impact sent shockwaves through supply chains. By early 2024, olive oil prices had more than doubled in many markets, this meant a typical bottle of extra virgin olive oil that might have cost $10 in 2022 was selling for $20-25. The crisis was ultimately averted through (1) increased imports with Tunisia emerging as an alternative supplier (2) trade policy adjustments where import tariffs were temporarily relaxed to allow for smoother inflows of olive oil from non-EU countries and (3) technological innovation where investments in drought-resistant olive varieties and more efficient irrigation techniques were accelerated.

// 5 // Record Trade Volumes and Shifting Global Trade Patterns

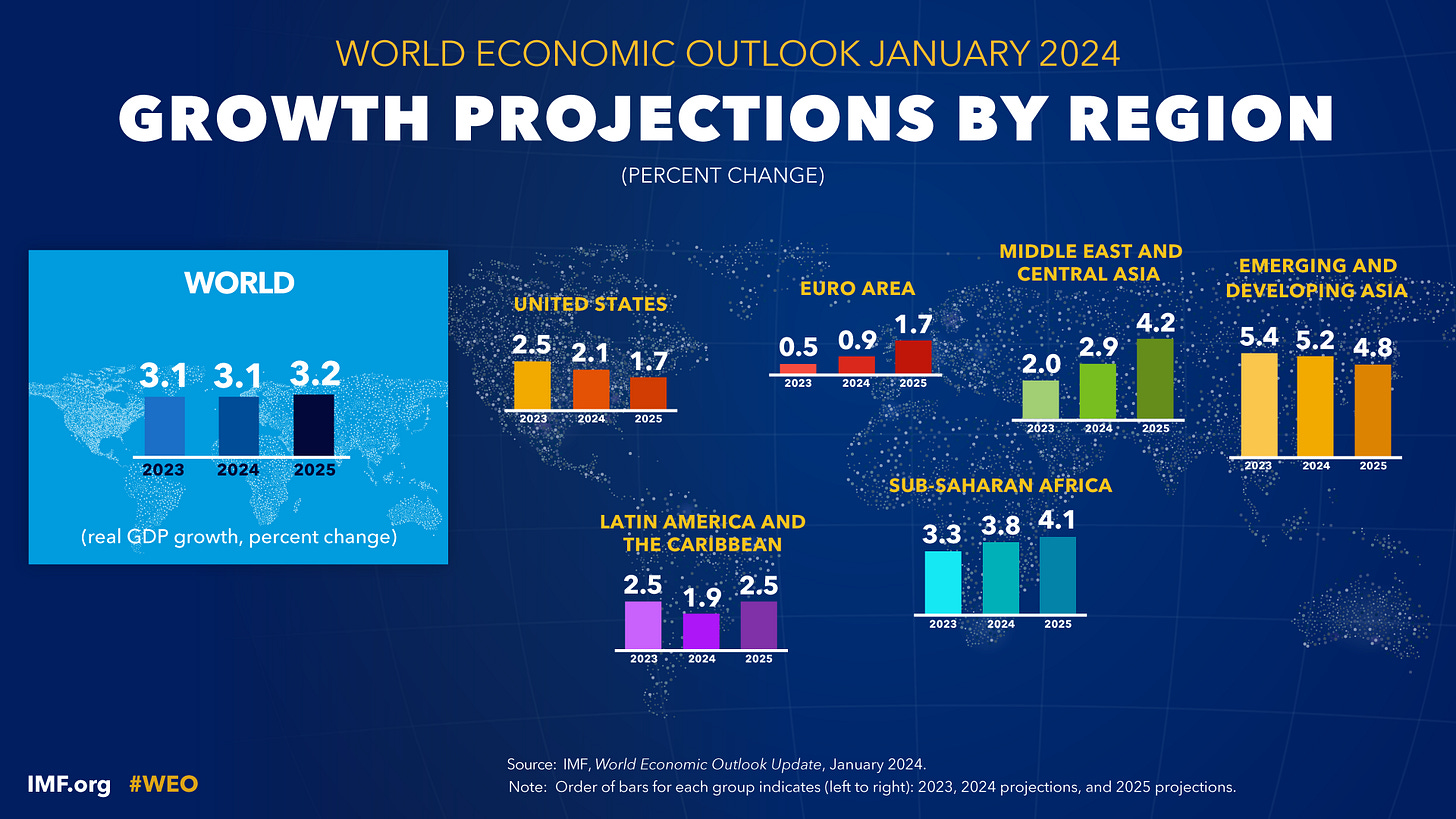

World Trade Organisation economists anticipate that the volume of world merchandise trade will increase by 3.0% in 2025 with trade patterns continuing to shift rapidly away from Western dominance.

Alternative currencies are also being explored to strengthen relationships with new partners and facilitate trade flows especially amongst BRICS nations as we noted in last month’s Post. The US dollar's uncertain path and US macroeconomic policy changes will continue to fuel momentum for alternative global trading currencies. Geopolitical tensions remain a top risk to trade in 2025, along with potential shifts in US policies with the threat of tariffs that could spark trade wars. The chart below highlights the trajectory of global trade over the last 5 years and its decrease from its post pandemic peak.

For those who are more curious, all the references and further reading for this edition below.

References and further Reading

Nvidia Bets on Robots to Drive Future Growth, The FT

Global Trade Update 2024, UNCTAD

5 Top Global Trade Stories of 2024, World Economic Forum

About the Transatlantic Post

A monthly editorial on innovation and international growth. With occasional British satire. Written and edited by Kajal founder and director of Growth Hub Global . Kajal has worked with more than 250 businesses to support their international growth efforts to the US, Middle East and India.

Who are our global community of readers..

Our readers are a globally minded, curious group of entrepreneurs, investors, academics and professionals across 26 countries. They are keen to learn more about the markets of the future and are predominantly based in the US, UK and Europe.

Email and subscribe notes

You are receiving this email because (1) you previously received the Transatlantic Post, from 2016 and have stuck with me as readers for several years (2) we worked together/crossed paths in 2022/2023 and spoke about innovation and growth in the USA, Middle East, India, as well as other markets (3) you would like to be kept up to date on shifting global dynamics and what that may mean for you and your business

We take your privacy seriously and your information is not used in any other way except to send this monthly email. If you prefer not to receive it, you can unsubscribe at any time.