Welcome to The Transatlantic Post an editorial on innovation and international growth. With occasional British satire. By Kajal

As a British author of a global newsletter, it was only a matter of time before I dutifully unleashed a Shakespearean Title post. A question that repeatedly arose in my mind after hearing our politicians remarks on trading and immigration.

A few days ahead of the UK election, the Labour Party have voiced a desire to improve the trading relationship with Europe and “do trade deals around the world” as well as a determination to reset Britain’s global image. There is a proposal to hold an investment summit in the first 100 days of Government to attract foreign investors.

This may prove a trickier operation as Europe swings to the far right and signals its rejection of globality. Resetting images, enticing the world’s best companies to see the UK and indeed Europe as an attractive place to invest - this need more than summits and handshakes after prolonged periods of political uncertainty.

As we look ahead to the second half of 2024 and whether we can preserve our sense of being global, a quick mid year recap.

A 2024 Mid year recap….

For those of you that missed earlier editions of the Transatlantic Post this year, I have written about the markets to watch in the East across sectors as well as relevant policies that will impact growth in years to come.

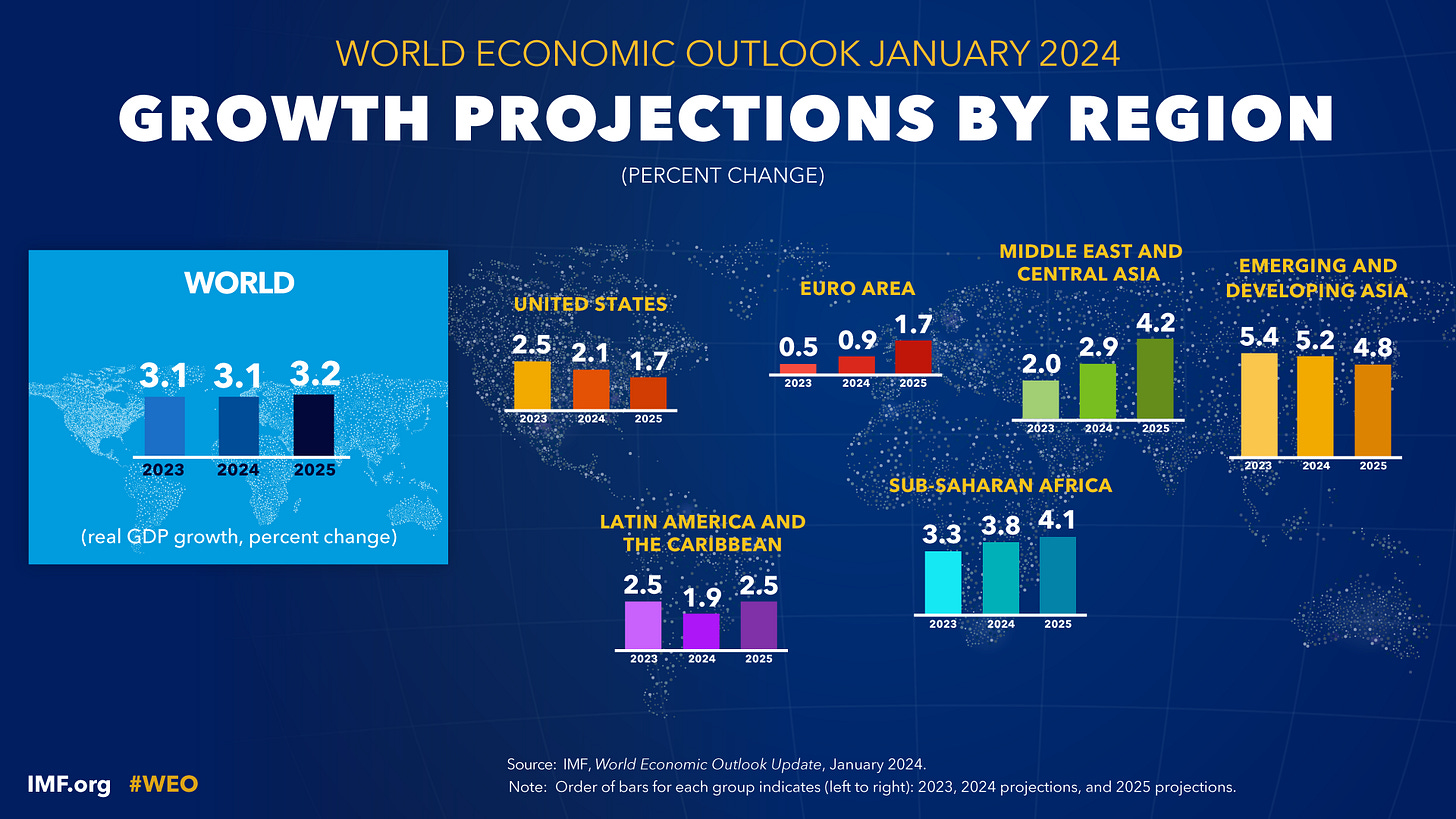

At the turn of the year, we focused on "The Next Decade of Growth ," particularly the UAE and India, and how their increasing trade may impact East-West trade. The IMF growth projections by region offer a sobering and stark view of the economic challenges that lie ahead.

In February, we noted the increasing influence of the Middle East in MEINA at DAVOS. By 2026, Gulf trade with Emerging Asia is expected to exceed that with advanced economies, and by 2030 will be worth US$757bn, almost doubling the value in 2021.

This is a significant geoeconomic shift that our future elected leaders will need to grapple with. How do the West remain relevant and compete for critical trade and investment? Very few candidates appear to be addressing this in recent political debates.

In March, for International Women’s Day we looked at Two global growth paths - the one with women and the one without. Countries in the East and West with more inclusive policies to protect and accelerate women’s economic contribution could add trillions to their economies. Although there is progress, there is still a long way to go.

The green economy across the East and West holds more promise as does the opportunity for global collaboration to solve our pressing climate issues. In “The Clean Energy Goldrush” we focused on the energy transition and global clean energy investment. Recent bilateral R&D efforts, climate tech innovation and funding partnerships between the East and West are for now a bright spot.

In our May edition, we covered the intersection of artificial intelligence and life sciences in You and AI are going to Live Forever (a twist on an Oasis song for those that didn’t see it!). Whilst it has hard to escape any conversation on AI, some of the most positive and pivotal changes will be how AI could transform healthcare to become both more efficient and equitable.

A global view from London Tech Week…

This month I attended London Tech Week. a conference that pitches itself as the global tech ecosystem coming together. Truth be told, it certainly felt like the world was under one Kensington Roof. Some of this year’s key themes included empowering entrepreneurship, Green Innovation and AI.

As the notion of globalisation has never felt more under threat than in 2024 - at London Tech Week, I witnessed a strong desire for continued global collaboration despite the environment of increased protectionism, trade barriers and geopolitical tensions.

Interestingly, right in the centre of the pavilion were IBM flanked by Ukraine to the left and Dubai to the right. Within two hours, I met with Qatar Research Development and Innovation Council, Dubai Department of Economy, the Cyprus Ministry of Commerce, The Hungarian Innovation Agency, the Japan External Trade Organisation and Innovate UK.

A whirlwind tour from Europe to Asia and Middle East also revealed how fiercly competitive the world has become to attract top businesses to their regions. Some countries emphasised tax incentives, their strategic location, and favorable regulatory environments.

More compelling, however, were those that presented specific value propositions for various industry sectors, such as a world-leading program in renewable energies. The focus on innovation clusters and the resulting knowledge diffusion and specialisation are often key factors for companies considering international investments.

Looking ahead in 2024….is the idea of being global dead?

This week, I spoke about this idea of leading with innovation clusters at the Future of Trade Panel hosted by the British Chambers of Commerce (BCC). At their Future of Economy conference on Thursday 1, the BCC CEO Shevaun Haviland reiterated how optimistic and ambitious businesses across the country to grow but Governments need to engage:-

“Government must work in partnership with business to create the right environment for economic growth. ….Our plan is to build an economy that has the green transition at its core, with a workforce fit for the future, living in thriving local places and powered by businesses that are globally facing and digitally enabled”

The Chambers recently released the “Global Britain Challenge Report” 2 which covers a number of ways to remain open and promote trade and investment from the UK. This includes concluding Free Trade Agreements with India and the Gulf Cooperation Council aswell as taking a targeted sector approach to accelerating investment.

Over the last two years in the UK, I met pioneers in life sciences, cleantech, energy and fintech with ambitions plans to grow internationally. They are clusters and sectors in which we have differentiated innovation in particular from our university spinouts.

From the grassroots, globalisation is far from dead. While our governments bet on election dates and call each other suckers and losers, pioneering businesses will get on with the job to solve global problems through innovation. Hearing their optimism, ambition, and desire to engage globally highlights the growing divide between current political discourse and the business community.

What is changing, however, is the way in which this is done being mindful of geopolitical risk. A recent article by McKinsey “Can your company remain global and if so, how? 3 highlights shifting strategies of larger companies to de-risk growth and taking a systematic approach to build “geopolitical resilience”. It is worth a read to understand how business leaders are preserving global roots despite the challenges.

With more than 60 countries and nearly 50 percent of the global population heading to the polls in 2024, our future leaders and their policies will play a crucial role in determining whether we can unlock economic growth through advancing global trade and investment, rather than retreating into divison and protectionism.

Last night, as I watched Coldplay at the Glastonbury Festival, featuring collaborative acts from Nigeria to South Korea, I felt more optimism for our musicians to inspire global unity than for our politicians. Whatever the rest of 2024 holds in store, watch this space...

“It has been said that arguing against globalisation is like arguing against the laws of gravity” Kofi Annan

Sincerely, yours,

About the Transatlantic Post

An editorial on innovation and international growth. With occasional British satire. Written and edited by Kajal founder and director of Growth Hub Global . Kajal has worked with more than 250 businesses to support their international growth efforts to the US and MEINA regions. Subscribe below.

Email and subscribe notes

You are receiving this email because (1) you previously received the Transatlantic Post, from 2016 and have stuck with me as readers for several years (2) we worked together/crossed paths in 2022/2023 and spoke about growth in the USA, Middle East, India, as well as other international growth led conversations.

We take your privacy seriously and your information is not used in any other way except to send this monthly email. If you prefer not to receive it, you can unsubscribe at any time.

References and Further reading

The Future of The Economy, Keynote Speech BCC CEO

Global Britain Challenge Report, British Chambers of Commerce

Can your company remain global and if so, how? , McKinsey Quarterly